More Growth at Kennerley & Co

On the 1st of February 2022, Cliff Jones merged his successful and longstanding practice (Business Partners Limited) with Kennerley & Co.

Josie, Pam and Nicola – all with many years experience with Cliff at Business Partners – joined the team at Kennerley & Co from that date, providing continuity to their client base, and invaluable expertise to the team in general.

To find out more about the team, check out our Key Personnel page.

Kennerley & Co

11 April 2024

Growth at Kennerley & Co

The past 12 months have been a busy time of growth for the firm, and it has seen the addition of 3 very senior staff members, and a new junior grad on the front desk.

We welcomed Marco in May 2022 at the same time as the firm took over the workload of John Faraq, upon John’s retirement. Marco has been working in public practice accounting since 2008.

In March 2023 Jason joined us on a Co-op Placement, which he was required to complete in order for him to complete his Bachelor of Business degree with the Auckland University of Technology. Now employed full time as a junior accountant, he takes his place at the front desk as he learns the ropes.

Vik joined the team in April 2023, upon Maurice Mar’s (of Simpson Mar Limited) retirement. He has over 25 years of experience, and will continue to provide the excellent level of professional service to his clients as he did while working with Maurice.

Helen also joined the team in April 2023, upon Raymond Khouri’s retirement. She has worked with Raymond since 2008, and provides welcome continuity to her client base which she has looked after for so long.

To find out more about the team, check out our Key Personnel page.

Kennerley & Co

6 April 2023

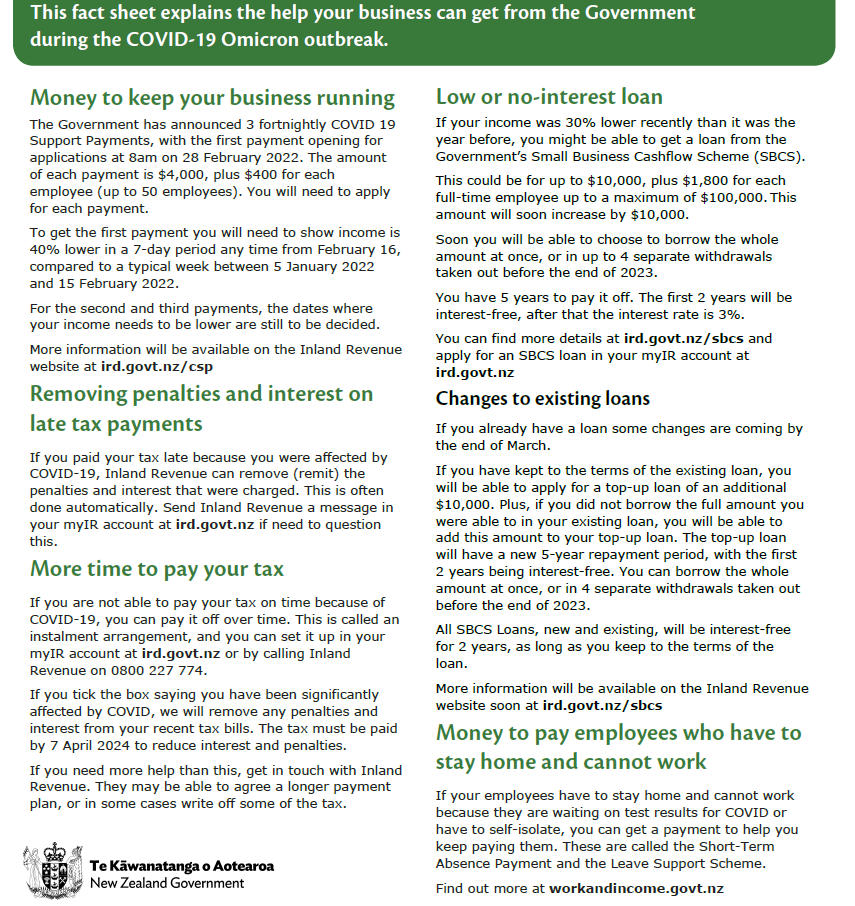

Help for your business during the Covid-19 Omicron outbreak

As a result of the ongoing isolation, testing and MIQ guidelines and requirements still in place, many businesses are suffering crippling financial situations. Below is a graphic outlining some of the recent announcements as to how an affected business may be entitled to assistance:

Kennerley & Co

28 February 2022

Clarification Around RSP (with applications closing 1 December 2021)

The Inland Revenue has today provided further guidance around the recent Resurgent Support Payments Scheme (as per our post of 29 October, immediately below), as follows:

“When the Resurgence Support Payments Scheme was created, applications were able to be made until one month after all of New Zealand had returned to COVID Alert Level 1.

The recent announcement of a move to the COVID-19 Protection Framework means the Alert Level system is being replaced. This means a new approach is needed to when applications for the RSP will close. It also requires a new approach to determining the end date of the period during which a decline in revenue must occur.

The Government has decided for the first three payments available during the current change in Alert Levels, the decline in revenue must happen on or before November 1. It has also decided that people will be able to apply for payments until the first business day that is one month after that date, which is December 1.

We’re aware that all these dates can be confusing. The following might make it simpler

for you and your clients.For the payments currently available a business must show a 30% decline in revenue over a continuous seven-day period at the raised Alert Level compared to a typical seven-day period in the six weeks prior to 17 August 21 (for more information about how that applies to new businesses or commonly owned groups, see our website).

• For the first payment, the seven-day period of revenue decline must fall within 17 August and 1 November. People can apply until 1 December.

• For the second payment, the seven-day period of revenue decline must fall within 8 September and 1 November. People can apply until 1 December.

• For the third payment, the seven-day period of revenue decline must fall within 1 October and 1 November. People can apply until 1 December.

• For the fourth payment, the seven-day period of revenue decline can start no earlier than 22 October, and the Government did not address the end date to this period in yesterday’s decisions. Note that people have been able to apply for this payment from 29 October.

We’d also like to remind you the Government has announced that payments will be available fortnightly, from 12 November, at double the current amount, which will continue until Auckland shifts to the COVID-19 Protection Framework. You can read more about that at https://www.ird.govt.nz/updates/news-folder/rsp-payments-to-increase-and-become-fortnightly.

We’ve heard that some business owners believe they’re only able to apply for one of the payments. Others believe it’s a loan that must be repaid. In fact, people can apply for all the payments if they’re eligible for them, and it’s a grant payment, not a loan.”

Kennerley & Co

2 November 2021

Business Register of Interest

On Friday 22nd October the Government announced an economic support package to support businesses affected by higher alert levels as the country transitions to the new COVID-19 Protection Framework. The announcement can be found here.

It includes a $60 million package for business advice and mental health support for Auckland businesses, specifically:

- Up to $3,000 worth of advice and planning support, and up to $4,000 to implement that advice.

- $10 million for mental health and wellbeing support through a programme that is to be designed.

If you are interested in receiving further information about this support, please complete the form here.

You will then be contacted as soon as information is available on how you can apply for this support.

If you have any further questions please contact info@businesshelpline.co.nz

Kennerley & Co

29 October 2021

Changes to the Resurgence Support Payment (RSP)

The Minister of Finance has announced the Government will increase the amount and frequency of the Resurgence Support Payment. You can see his press release at www.beehive.govt.nz.

The next payment, which is available from 29 October through myIR, will remain at the current rate of $1,500 plus $400 per full-time equivalent (FTE) employee, up to a maximum of 50 FTE.

Subsequent payments will be for $3,000 plus $800 per FTE, still up to a maximum of 50 FTE.

The frequency of the payments will also change. They will be available fortnightly, on 12 November, 26 November, and 10 December as long as Auckland has not moved to the COVID Protection Framework.

To apply or find out further detail, please click here if you are an employer or here if you are self employed.

Please also see here for a summary of the various types of subsidies available.

Kennerley & Co

22 October 2021

Lockdown Deja Vu

Whereas an increasing number of jurisdictions around the world (most recently and notably, Alberta, Canada and now Denmark) are making the conscious decision to live normally with Covid and are therefore rescinding mitigation measures and restrictions, the New Zealand government is – for the time being – persisting with the strict “elimination” approach.

This is obviously going to negatively effect many businesses – some significantly so.

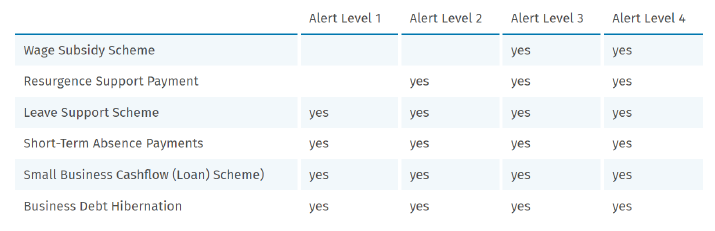

The following is a summary of monetary relief that may be applicable to you as a business operator:

- Eligible businesses expecting a loss of 40% revenue (over the period 17 August to 30 August 2021) compared to a typical 14 day period in the previous 6 weeks (or for seasonal industries, for the same period in 2020 or 2019) will be able to apply for the Wage Subsidy scheme on Friday 20 August.

- Businesses will be eligible for $600 per week for full-time equivalent employees and $359 per week for part-time employees (for a maximum of two weeks)

- Resurgence Support Payment (a one-off payment made to businesses when a COVID alert level is increased for at least 7 days or longer) will also be available

To apply or find out further detail, please click here if you are an employer or here if you are self employed.

Please also see the below table for the following for other types of subsidies available, more information on which can be found be clicking here:

EDIT – 1 September 2021:

Applications for a second round of Wage Subsidy – to be known as “Wage Subsidy August 2021 #2” – open at 9.00am on Friday 3 September.

Kennerley & Co

18 August 2021

Major Changes: Tax rules around Residential Rentals and Capital Gains on Property

The government has proposed two major property related changes: the removal of interest expense as an allowable tax deduction against residential rental income, and an extension of the Brightline period from 5 years to 10 years.

Interest deduction changes – drastic measures proposed

Currently when owners of residential investment property calculate their taxable income they can deduct the interest on loans that relate to the income from those properties. This reduces the tax they need to pay.

It is proposed that for properties acquired before 27 March 2021, interest deductions will be phased out from 1 October 2021 over next four years by 25% each year. No interest deduction will be available from 01 April 2025.

This measure is likely to have a significant impact on the after-tax profit from rental activities and the net cash position for the Taxpayer.

It is worth noting that while Government went ahead with the introduction of these changes, the Treasury had advised the government against doing so, given the lack of proper consultation and analysis.

Just one unintended consequence of this change is the heightened uncertainty it creates, around any possible future legislation change. This is because previously, all tax legislation generally abided by the over-arching principle that any expense incurred with the purpose of deriving or increasing one’s taxable income, was deductible for tax purposes.

For the first time, a proposed change to tax legislation essentially goes against this principal – meaning that other such changes may be on the table.

Brightline Extension

Currently the bright-line test imposes income tax on gains derived from the disposal of residential property within five years of acquisition (if the property was acquired after 28 March 2018), unless exceptions apply (such as if the residential property is the taxpayer’s “main home” or if it is inherited property).

The bright line period will now be doubled from five to ten years (except for New-Builds, for which the period remains five years).

The new 10-year period will apply to residential property acquired on or after 27 March 2021, unless an offer was made before 23 March 2021 that was irrevocable before 27 March. If the property is sold within 10 years of acquisition (unless exclusions apply), any gains will be taxable.

Commentary

Had the Brightline change been announced by itself, there is no doubt it would have garnered considerably more attention – not to mention criticism, in light of recent promises from the government that no such change would be made.

However – and perhaps this was the intention – the change in Brightline now pales in comparison compared to the drastic changes around interest deductibility.

Kennerley & Co

15 April 2021

March 21 Wage Subsidies

Wage subsidy is being made available to employers affected with rise in alert levels on 28th February 2021.

Purpose: To provide support to employers whose business has been affected due to rise in alert Levels on 28 February 2021 so that they can continue to pay employees and keep employees employed.

Status: Available now

Payment: Paid as a 2-week lump sum at the rate of:

• $585.80 a week for each full-time employee retained (20 hours a week or more)

• $350.00 a week for each part-time employee retained (less than 20 hours a week).

Eligibility: New Zealand businesses that have had or expect to have a 40% decline in revenue over a consecutive 14-day period between 28 February 2021 and 21 March 2021, compared to a typical 14-day period between 4 January 2021 and 14 February 2021 (6 weeks before the change in alert levels).

Businesses with highly seasonal revenue are be able to compare decline in revenue to the same period of 14 consecutive days in 2020 or 2019.

Business must have taken active steps to mitigate the financial impact of the alert levels.

Condition: Condition of wage subsidy is that the employer must retain the staff for the period of the Subsidy

Other COVID

Benefits: A business is entitled to receive only one COVID 19 benefit for the same employee at any onetime. These include

• March 21 Wage subsidy

• Leave Support Scheme Payment

• Short Term Absence Payment

A business may however be entitled to receive COVID 19 – Resurgence Payment at the same time as receiving any of the above, as that payment is to assist with covering of business costs and is not linked to an employee.

Paying Staff: A Business receiving the COVID-19 Wage Subsidy March 2021 must:

• try hardest to pay staff at least 80% of their usual wages;

• if that isn’t possible, pay at least the rate of the Wage Subsidy

• if the employee’s usual wages are lower than the rate of the Wage Subsidy, continue paying that amount for the duration of the subsidy.

Income Tax: Wage Subsidy paid to the employer is not taxable and also non-deductible when paid by the employer to the employee as part of wages. Wage Subsidy paid to the employee is taxable to the employee and is subject to PAYE, Student Loan and Kiwisaver deductions. GST: Not subject to GST.

How to apply: Applications can be made by clicking here.

Please note that you will be asked to declare that you meet the criteria and agree to the obligations for the use of this payment. All payments will be subject to audits and reviews.

Kennerley & Co

5 March 2021

COVID-19 resurgence support payments

On 17 February 2021 the Government activated the Covid Resurgence Support Payment.

The Resurgence Wage Subsidy covers a 2-week period and will run from the date you apply.

To be eligible, businesses must experience a 30% drop in revenue or more over a 7-day period after the increased alert level (from level 1) – as well as meet a range of other RSP eligibility criteria.

You can find full information on the IR website here; and applications can be made via your myIR account – see here.

In addition, on 8 February 2020 the Government announced a new COVID-19 Short-Term Absence Payment (STAP) to support employers and self-employed workers.

The STAP is available through WINZ from 9 February 2020 to employers for employees, and self-employed workers, who need to miss work to stay at home while waiting on a COVID-19 test result, AND cannot work from home.

The STAP is a one-off payment of $350, and GST is not payable on the STAP.

For self-employed workers the STAP is considered income, so must be included on their Individual income tax return (IR3).

More information can be found at WINZ here, and applications can be made here.

Kennerley & Co

26 February 2021

The Tax Man would like to have a little bit more, please…

A new top tax rate of 39% will apply on personal income in excess of $180,000 for the 2021-2022 and later tax years. For most taxpayers this begins on 1 April 2021.

Affected clients who are provisional tax payers may need to adjust their provisional tax payments throughout 2021 to account for the larger year-end tax bill.

Kennerley & Co

26 January 2021

Resurgence Wage Subsidy – COVID 19

If your extension wage subsidy is coming to an end and you are still experiencing adverse impact of COVD 19 you may be able to apply for the new Resurgence Wage Subsidy which is available to support employers, including self-employed people, who are significantly impacted by the resurgence of COVID-19. Please be mindful that you can only receive one COVID 19 wage subsidy at any one time per employee.

Click here to apply, but please first read the detail below.

• The Resurgence Wage subsidy covers a 2-week period and will run from the date you apply.

• A Wage subsidy extension can be applied for, even if you haven’t applied for the Wage Subsidy or wage subsidy extension.

• Applications can be made from 1 pm on 21 August 2020 to 3 Sept 2020. The applications are made to employers throughout NZ.

• You must not apply before the end of current wage subsidy extension as you can’t received more than one wage subsidy at any one time for the same employee.

• Business must have, or expect to have a revenue drop of 40% or more due to COVID 19, for a 14-day period between 12 August 2020 to 10 September 2020 compared to similar period last year and the decline must be related to COVID 19.

• Your business must be registered and operating in NZ and the employees covered by Resurgence Wage Subsidy must be legally entitled to work in NZ. Businesses operating for less than a year or have high growth

• New businesses which have been operating less than a year, or high growth businesses (e.g. that have had a significant increase in revenue), can apply for the Resurgence Wage Subsidy.

• To determine whether these businesses meet the 40% decline in revenue assessment, they must compare their revenue against a 14-day period that gives the best estimation of the revenue decline related to COVID-19.

The business must have taken active steps to mitigate the financial impact of COVID-19.

Employers are required to agree that, for the duration of the Resurgence Wage Subsidy, they will retain the employees the subsidy was paid for. If you are receiving the COVID-19 Resurgence Wage Subsidy, you must:

• try your hardest to pay staff at least 80% of their usual wages;

• if that isn’t possible, pay at least the rate of the Resurgence Wage Subsidy that applies to that employee

• if the employee’s usual wages are lower than the rate of the Resurgence Wage Subsidy, continue paying that amount for the duration of the subsidy.

The Resurgence Wage Subsidy will be paid at a flat rate of:

• $585.80 for people working 20 hours or more per week (full-time rate)

• $350.00 for people working less than 20 hours per week (part-time rate).

The subsidy is paid as a lump sum and covers 2 weeks per employee from the date of submission of application. Keep in mind you’ll be asked to declare you meet the criteria and agree to the obligations for the use of this payment. All payments will be subject to audits and reviews.

Kennerley & Co

18 August 2020

Extension to the Wage Subsidy Scheme – COVID 19

As part of the recently announced Budget, the government has introduced a 2nd Wage Subsidy payout, to cover a further 8 weeks (in addition to the initial 12 weeks).

The extension is available to those businesses that have suffered a 50% reduction in turnover in the 30 days prior to application as compared to the same time frame in 2019.

[Edit: on the 5th of June, the reduction in turnover requirement was reduced to 40% (from 50%) in the 40 days before applying (starting no earlier than 10 May 2020), compared to a similar period in the previous year.]

Kennerley & Co

15 May 2020

IRD lending scheme to support small and medium sized businesses

Because of concerns that the previously discussed Business Support Loan scheme (see previous post below) is unlikely to be of much use to many (if not most) smaller businesses, the Government has released some details about a new Small Business Cashflow Loan scheme.

Up to $100,000 will be available to businesses employing 50 or fewer full-time equivalent employees.

Additional eligibility criteria include:

- The usual wage subsidy scheme criteria (as covered in our earlier article); and,

- A declaration that the business is viable and will use the money for core business operating costs.

The loan amount is calculated as $10,000 per applicant plus $1,800 per full time employee. For example, a business with 5 full time staff could be eligible for a loan of $19,000.

The loan will be for a maximum 5 years, with repayments not due in the first 2 years. If the loan is repaid within the first two years, no interest will be added; otherwise, a 3% interest rate applies.

Inland Revenue will administer and audit the scheme, with applications open from 12 May, and closing 31 December 2023. A decision to grant or decline a loan will not disputable and information can be shared with the Ministry of Social Development (MSD) (the administrators of the wage subsidy) to administer the scheme.

For more information and to apply, please click here.

Kennerley & Co

8 May 2020

Updated for scheme changes: 23 November 2020

Business Support Loans

Banks are offering Business Support Loans to help meet liquidity and bridging financing requirements arising from disruption caused by COVID-19.

The loans are being made available as part of the Government’s Business Finance Guarantee Scheme. The scheme involves a range of participating banks and is designed to help protect jobs and support the economy.

Availability of short term business loans may help those businesses still affected by the lockdown to push through for longer.

Businesses with annual revenue between $250,000 and $80 million may qualify, and each eligible business or business group can apply for a single loan of up to NZ$500,000 for a maximum term of 3 years.

Loans are available until 30 September 2020 or when all available funds are allocated (whichever is first).

The purpose of the loan must be primarily to meet liquidity and bridging finance requirements to deal with disruption caused by COVID-19.

Special variable interest rates will apply. Discounted fees and charges may also apply.

As with any other loan, you remain responsible for repaying 100% of the loan and interest, and usual security arrangements may also apply.

For more information on the Business Finance Guarantee Scheme please visit the Government’s COVID-19 financial support website.

Kennerley & Co

29 April 2020

Latest Government Announcement: New Measures to provide relief for businesses in relation to COVID 19

On the 15th of April 2020 the Government announced a suite of new measures for small to medium sized businesses in order to provide relief in relation to the effects of the current COVID 19 measures. There are three tax related measures included as follows:

Greater flexibility in respect of statutory deadlines

The IRD will be given discretionary powers to grant an extension to due dates and time frames such as extending deadlines for filing of tax returns and paying provisional and terminal tax.

At this stage the power will be limited for a period of 18 months and will apply to businesses affected by COVID-19.

Our recommendation (based on the IRD guidelines) is that normal filing and payment dates be kept unless it can be shown that genuine circumstance make this impossible.

Changes to the tax loss continuity rules

New Zealand’s current rules are quite stringent when compared to other parts of the world. It requires a minimum of 49% continuity of ultimate shareholders for a company to carry forward losses, which can be restrictive when companies need to raise capital.

The proposed changes are to allow companies to apply “the same or similar business test” which will be modeled on the Australian rules and will apply from 2020/2021 tax year. This will be a welcome change to businesses that may need to raise additional capital by way of selling company shares to investors. The legislation is due to be included in the Bill in the second half of the year.

Introduction of a “Loss Carry Back” Scheme

This is possibly the most interesting tax measure. Businesses will be able to offset a loss in a particular tax year against a profit in previous year and receive a refund of tax paid in previous profitable year. The proposed mechanism will provide cash flow assistance to businesses that are or anticipate being in a loss situation.

A temporary rule will be introduced for 2020/2021 tax year whereby the loss will be able to be carried back to the 2019 or 2020 tax year to allow for a refund being paid. The temporary rule will allow a loss to be estimated. However as with any estimation, if an estimation is made and a refund is made incorrectly then UOMI will apply.

For later years the loss will need to be confirmed in a tax return before it can be carried back to a prior year. The permanent rule will be legislated later in the year.

Temporary legislation will be introduced in the week of 27th April, at which stage hopefully some of the currently unknown detail around how this will work exactly can be ascertained. As such, if you think this may be applicable to you or would like to know if it may be applicable to you, we would be grateful if you would wait until the legislation is passed before making enquiries.

In any case, you can rest assured that when we come to prepare your annual financials, we will apply the most tax efficient options allowable in your particular case.

Kennerley & Co

18 April 2020

Modifications to Wage Subsidy Scheme – COVID 19

On 27 March 2020, a further announcement was made by the Government regarding modifications to the wage subsidy scheme. The aim of these were to ensure that people did not lose their jobs during the national lockdown.

The modifications which took effect at 4 pm on the 27 March 2020 include the following:

• Every business has an obligation to use their best endeavours to pay employees 80% of their normal income. If this is not possible, (i.e. where all business activity has ceased) the employer must pass on at least the entire amount of the wage subsidy to each affected worker.

• It was also clarified that if the worker’s income is normally less than the wage subsidy, then the worker should be paid their normal salary. It is the employers responsibility to make an assessment of what is to be paid to each employee by taking into consideration their normal working hours before the COVID-19 lockdown.

• Every business has the obligation to keep employees in employment for the period of the subsidy (being 12 weeks).

• The previous sick leave scheme is no longer available, unless applications were made before 3 pm on 27th March 2020. This is to ensure that no double dipping arises. The sick leave scheme was designed when few people were in self-isolation; as the entire country is in lockdown this is no longer appropriate.

The Government is working on arrangements for those in essential work requiring sick leave due to COVID-19. We will keep you informed of further developments.

These Government rescue measures were introduced and amended as appropriate, to prevent mass redundancies due to COVID-19. Businesses that either operate remotely or businesses whose workers are able to work during the lockdown are still required to pay their workers in accordance with their employment agreements.

In summary the wage subsidy is:

• $585.80 a week for full-time worker (working 20 or more hours p/week before COVID-19) and

• $350 a week for part-timers (working less than 20 hours p/week).

Every qualifying business will receive wage subsidy by way of a lump sum payment covering 12-week period per each employee specified on the application and can be made using the following links:

Employer applications

Sole Traders applications

Note to those self-employed but also employing other PAYE employees:

You can use the ‘employer’ form and include shareholders as employees if those shareholders are paid a wage, salary or draw an income for the work they do for the business; those qualifying shareholders need to have their details entered into the employee section of the form.

Please be sure to read the general information as well which can be accessed through this link

We recommend that you like our Facebook page so that you are notified as and when updates are made.

Kennerley & Co

1 April 2020

IRD’s Statement to businesses

“If your business is unable to pay its taxes on time due to the impact of COVID-19, we understand, you don’t need to contact us right now. Get in touch with us when you can, and we’ll write-off any penalties and interest.

It would help if you continue to file however, as the information is used to make correct payments to people, and to help the Government continue respond to what is happening in the economy.”

Source: IRD Website

Kennerley & Co

25 March 2020

Yes! We are are fully operational

As everyone well knows, the only things certain in life are death and taxes.

As such we plan to continue operations more or less as per usual throughout the lock-down period. We have procedures in place to securely and effectively work from our various homes.

The only thing to note is that almost all phone calls will go to voicemail – which will instruct you to contact us by email.

Our email addresses can be found here.

If you haven’t already, we recommend you follow us on Facebook so that you receive our updates as we post them.

Kennerley & Co

24 March 2020

Tax leniency measures – further detail

Following our earlier article summarising some of the relevant parts of the $12.1 governmental relief package (see below), we have obtained further clarification from the IRD around the tax relief component.

Terminal tax payments

This leniency concession is not available for terminal tax payments relating to the 31 March 2019 tax year (e.g. terminal tax due on the 7th of April 2020). This is because the IRD says that liability arose in a tax year that was prior to the outbreak of coronavirus.

Late payment penalties

The IRD has confirmed it will also exercise its discretion to waive late payment penalties for those eligible for the interest remission on late payment. So again, not likely to relevant to any terminal tax payable on the 7th of April 2020.

Clarifying what a 30 percent decline in revenue means

IRD is aligning the interest waiver to the tests used by the Ministry of Social Development (MSD) for providing wage subsidies.

As per MSD’s guidelines, IRD says taxpayers must have experienced a reduction of at least 30 percent in revenue between January 2020 and 9 June 2020 as a result of coronavirus to be eligible to apply for the concession.

That decline can be in actual revenue or predicted revenue (e.g. a motelier sees a reduction in bookings). Businesses must compare one month’s revenue against the same month from the previous year to determine that decline (e.g. March 2020 to March 2019).

If you’ve got the ability to pay, you must pay

IRD is adamant the remission of interest is only for taxpayers experiencing hardship who have exhausted all other options. It wants those who have the funds (or means to access funds) to pay their tax on time and will act accordingly if they don’t.

How does one apply for the concession?

IRD is still working through the detail and a framework at this stage. Legislation will be introduced in early April. However, it says those wanting to receive the interest concession should apply to enter an instalment arrangement in the first instance. This can be done by phoning the department or via myIR.

IRD will waive any interest they normally charge as part of this arrangement once the bill containing the coronavirus remission legislation is enacted.

In Summary

Very little has changed compared to normal, in practical terms. While many have gotten the impression they might be able to have some or all of their tax waived, all it really means is that the IRD might – in exceptional circumstances – waive the interest component of late payment.

We have a good history of having our client’s late payment penalties waived upon request, so nothing has really changed in that regard. (Edit: but please see our more recent posting on the 25th of March, which now clarifies that the IRD are providing broader sweeping and general leniency with regards penalties and interest).

Kennerley & Co

20 March 2020

$12.1 billion governmental support package – does it apply to you?

A $12.1 billion package to support New Zealanders and their jobs from the global impact of COVID-19 has been outlined by the New Zealand government. For business operators and investors, there are two pertinent parts of the package that may be of most interest.

The first – and of most direct benefit – is a $5.1 billion in wage subsidies for affected businesses in all sectors and regions, available from the 17th of March 2020.

To benefit from this, businesses will need to show a 30 percent decline in revenue for any month between January and June 2020, or show that your employees have been directly affected by COVID-19 to the detriment of your business. (I decrease in forecasted revenue can also be used if the forecast is reasonable; e.g. if you can show a drop in future bookings compared to normal).

To see if your business qualifies and for further detail please see here; and to make an application, please click here.

In general, we recommend you make a claim based on genuine and legitimate circumstance and using clear and transparent data, and leave it to WINZ to report back to you if they feel you need to amend your application.

(Edit: Feedback indicates that applications are being accepted and processed very quickly. Our assumption is that this is a result of the sheer volume of applications, the need for WINZ to be seen to be following through, and perhaps also a reliance on the threat of future criminal prosecution to prevent false information being included in applications).

Edit 25/03/2020: the IRD have provided more clarity around the GST and tax related treatment of the wage subsidy:

The second part of the package relevant to business owners and investors is the $2.8 billion in business related tax changes, to be implemented over the coming year or two with the aim of freeing up tax payers’ cashflow. We suspect that a number of these items were already on the cards (to be implemented in the near future) but have now been fast tracked.

The changes include a provisional tax threshold lift from $2,500 to $5,000, the reinstatement of building depreciation on commercial properties, and allowing for greater leniency around writing off IRD interest expense incurred on the late payment of tax (where hardship relating to Covid-19 can be shown). There will also be greater flexibility in adjusting downwards the 20/21 provisional tax installments where it is likely that total profit is going to be significantly decreased as a result of the tax measures.

(Note that for depreciation on commercial buildings, the IRD currently state a start for the 20/21 tax year; whereas the official government fact-sheet indicates a 21/22 start. We are attempting to ascertain which is correct).

There is also an increase of the “low value asset” threshold from $500 to a temporary $5,000 (for the 20/21 tax year only, and reduced to $1,000 for future years). This means any asset purchased for less than $5000 can be fully deducted in the year of purchase – rather than being added to the Fixed Asset Register and depreciated over a number of years. The reasoning behind this change is that it may encourage business and rental property owners to carry on purchasing and upgrading in what are rather uncertain times.

If you are a client of ours, rest assured that we will implement the relevant tax changes in the ordinary course of your annual tax planning, so that you benefit as much as is allowable under current and future legislation.

To read the full statement from government, and to access the supporting fact-sheets please click here.

For the IRD’s updated answers to common questions around all of the above, please see here.

Kennerley & Co

18 March 2020

(Most recent update: 25 March 2020)

Online Offshore Shopping: GST at purchase now applies

Are you an ASOS addict? Urban Outfitters or Amazon perhaps? Whatever your online purchasing preferences, there are some recent changes that are very likely to affect you directly as a consumer.

You won’t notice much difference in your online shopping process – other than that your overseas sourced products will now come at a higher cost (by 15% generally speaking).

This is because on 1 December 2019, the new “low-value goods” regime came into effect. This imposes goods and services tax (GST) at 15% on goods acquired by New Zealand consumers from offshore suppliers.

The new regime applies to goods with an individual value of NZ$1,000 or less and will require a wide range of overseas sellers to register and account for GST on sales to New Zealand customers.

In most cases, it is expected the overseas sellers will increase their prices by adding the GST to the amounts payable by New Zealand customers. I confirmed this myself in my recent Vitacost.com order – they now automatically add 15% GST to my online purchase which they had not needed to previously.

Note that this means that on overseas items on which GST is charged at the time of purchase, you no longer have the “wait and see (and hope for the best)” scenario we had previously where sometimes GST and/or duty was added upon arrival in the country. (Although it should be noted for packages with a total value of $1,000 or more, customs duty and import entry fees – which is not the same as GST – may still be added upon entry into the country).

Although we aren’t usually pleased at the prospect at having to pay more for our online shopping habits, this new regime does in fact even out the playing field for our local suppliers. Previously, overseas suppliers had an automatic 15% price advantage over purchasing from your local shop.

Effectively, this advantage has been removed meaning our local suppliers will hopefully see an increase in their sales, and more of our hard earned cash stays within the New Zealand economy for longer.

Kennerley & Co

17 December 2019

Property Ownership: Capital Gains Tax and Ring Fencing

The government has recently canned any likelihood of implementing further capital gains tax for now (and it would seem, for the foreseeable future). This means the current limited capital gains tax scenarios remain unchanged (including the Brightline legislation introduced in the last few years).

However, for the residential rental owners out there there is still a likely significant change on the cards. “Ring fencing” of residential losses (on negatively geared property) is still on the table; and if the legislation goes through it is likely to be in effect from the current financial year.

If this does goes ahead (and the pundits seem to think it will), residential losses will not be available to offset against your other (non-rental) income. This means that if you have been utilising residential losses to generate a chunky income tax refund to yourself in the past, it is likely that you will no longer be able to do this.

As always, feel free to contact us if you require clarification, or if you would like to have us review your current investment structure to ensure it is optimised.

Kennerley & Co

13 May 2019

(Edit: We can confirm that this legislation has now come into effect since the original publishing of this post).